Investasi dan perdagangan

Mengapa Berinvestasi?

Kami berkomitmen untuk memberikan akses kepada klien kami terhadap teknologi canggih dan dukungan profesional untuk manajemen investasi dan trading yang sukses.

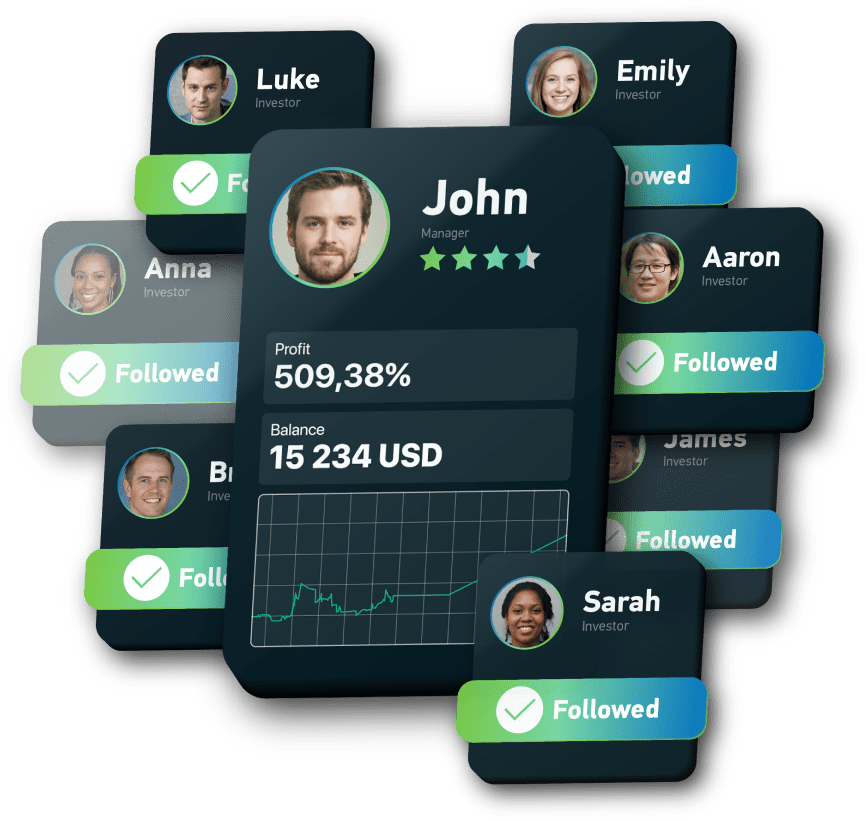

Copy trading platform

Buat akun Copy Trading dan hubungkan ke satu atau lebih strategi dari peringkat.

Pilih strategi berdasarkan pertumbuhan keuntungan bulanan dan saldo akun. Untuk meminimalkan risiko, atur rasio salin dan batas drawdown.

Trading di bursa saham memiliki risiko, sehingga wajar merasa tidak yakin dengan kemampuan Anda.

Untuk mulai melakukan transaksi yang menguntungkan sejak awal, gunakan pengalaman para profesional — hubungkan akun Anda ke strategi mereka. Sistem akun Copy Trading akan secara otomatis mengikuti transaksi mereka.

Investasi minimum per satu strategi trading.

Satu akun Copy Trading untuk ratusan strategi.

Copy trading untuk Investor

Pelajari lebih lanjutSistem kontrol risiko. Investor menetapkan batas drawdown mingguan. Anda dapat memutuskan koneksi dari suatu strategi dan menutup transaksi kapan saja.

Order dieksekusi secara instan dengan harga yang sama, sehingga memastikan komisi terendah untuk setiap transaksi. Ini berarti potensi keuntungan yang lebih besar, terutama untuk sistem trading frekuensi tinggi.

Perhitungan lot otomatis untuk pembukaan posisi. Anda hanya perlu menentukan jumlah investasi dan batas kerugian mingguan. Semua parameter lainnya akan dihitung secara otomatis berdasarkan rasio antara investasi Anda dan dana manajer.

Copy trading untuk Master

Dapatkan hingga 50% dari keuntungan investor Anda: Anda yang menentukan biayanya.

Trading sendiri, atau gunakan EA dan strategi frekuensi tinggi.

Keuntungan ditransfer secara otomatis pada akhir setiap periode trading.

Portofolio Investasi

Portofolio adalah alat universal yang cocok untuk pemula maupun trader berpengalaman.

Portofolio memungkinkan distribusi dana ke beberapa instrumen dan, sebagai hasilnya, mencapai tingkat keuntungan yang lebih tinggi.

Kunci kesuksesan portofolio terletak pada keseimbangan aset.

- Berinvestasi pada blue chip – saham perusahaan terkemuka

- Perlindungan modal

- Enam tahun rekam jejak kesuksesan

- Syarat margin yang fleksibel

- Portofolio investasi gratis untuk klien kami

- Aset yang dipilih oleh analis terbaik

Perbandingan layanan investasi

|

|

Copy trading

|

Portofolio investasi

|

|---|---|---|

|

Anggaran minimum

|

100 USD

|

1000 USD

|

|

Instrumen perdagangan

|

Bebas, tergantung pada strateginya

(mata uang, saham, logam, komoditas, indeks, barang) |

Saham, indeks, logam

|

|

Penyebaran risiko

|

Ya.

Memungkinkan untuk berinvestasi ke berbagai strategi, mengatur rasio penyalinan sesuai keinginan, serta menetapkan batas untuk keuntungan dan kerugian. |

Ya.

Portofolio dibentuk setiap bulan berdasarkan analisis sejumlah besar data. Aset yang seimbang memungkinkan maksimalisasi keuntungan dengan risiko minimal. |

|

Kurva pembelajaran

|

Mudah

|

Menengah

|

|

Perdagangan independen

|

Tidak

|

Penempatan dan penutupan trading secara mandiri

|

|

Investasi

|

Dalam strategi perdagangan

|

Dalam aset pasar

|

|

Untuk siapa

|

Penyebaran risiko

|

Semua orang

|

|

Perkiraan keuntungan pertama

|

Hari berikutnya setelah investasi

|

Portofolio dirancang untuk periode 1–6 bulan. Meski profit pertama bisa terlihat keesokan harinya, disarankan menunggu minimal 1 bulan untuk memaksimalkan keuntungan.

|

|

Perkiraan hasil

|

Tergantung pada strateginya

|

Rata-rata, 15–25% per bulan

|

|

Peringkat

|

||

|

|